Who handles your payment and tax processing?

Who handles your payment and tax processing?Our plugins are sold through our official reseller, Paddle.

All payments are processed via credit card or PayPal. Paddle also handles VAT/GST collection and invoicing.

Paddle’s receipts include their VAT/GST number for your records.

You can read more about how they handle tax compliance here: Paddle – Tax and Compliance

Paddle – Tax and Compliance

When is VAT/GST applied?

When is VAT/GST applied?If you're located in a country where VAT or GST applies, it will be automatically added at checkout.

Can I enter my company VAT number?

Can I enter my company VAT number?Yes — if you have a valid company VAT number, you can enter it during checkout.

If it verifies successfully, the VAT will be automatically removed from the total.

What if I forgot to add my VAT number?

What if I forgot to add my VAT number?If you didn’t enter a VAT number during purchase — or if it wasn’t validated — you can still request a VAT refund from Paddle after the purchase.

How to request a VAT refund from Paddle

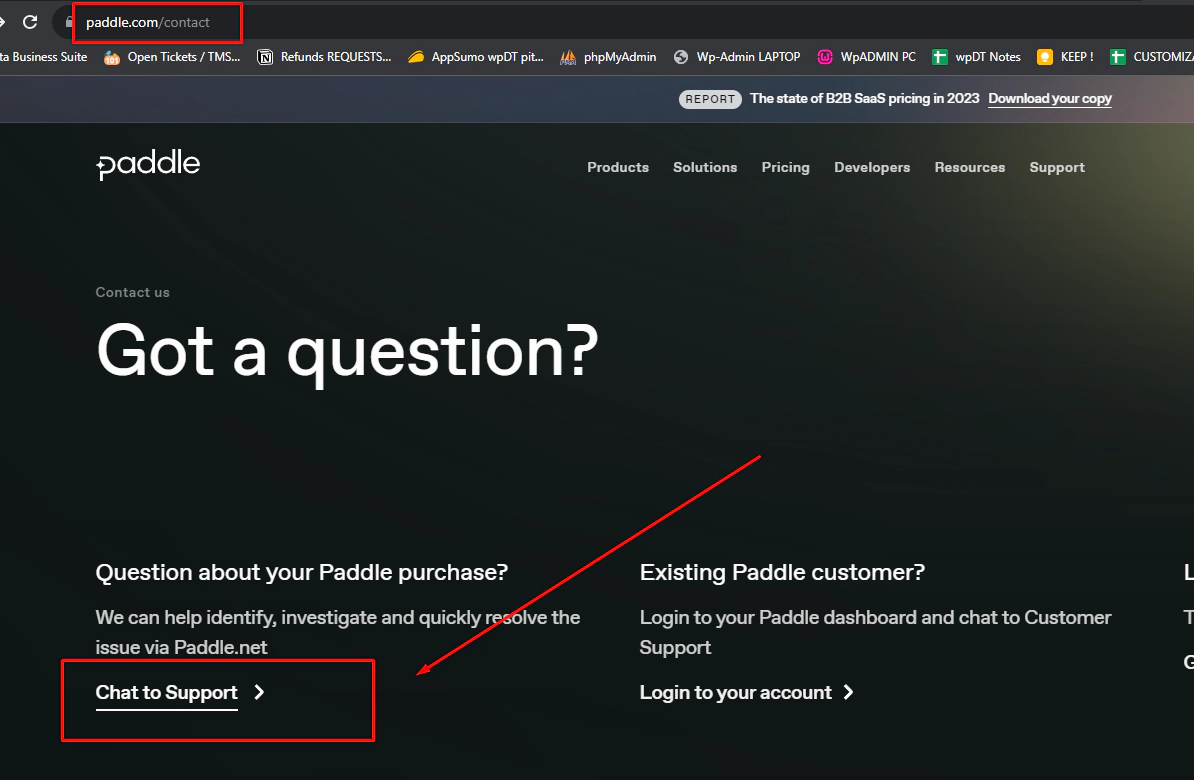

How to request a VAT refund from PaddleGo to: Paddle Contact Page

Click “Chat to Support”

Start the chat with the topic: “VAT refund”

Type “Human support” to speak to a live agent

Share your payment details and valid VAT number

Need help?

Need help?This is currently the only process available for retroactive VAT refunds.

If you have any questions along the way, feel free to reach out to our support — we're happy to help!